2009/09/17 Ghost fleet anchored just east of Singapore

2009/09/17 Ghost fleet anchored just east of SingaporeThe biggest and most secretive gathering of ships in maritime history lies at anchor east of Singapore. Never before photographed, it is bigger than the U.S. and British navies combined but has no crew, no cargo and no destination - and is why your Christmas stocking may be on the light side this year.

|

|

| The 'ghost fleet' near Singapore. The world's ship owners and government economists would prefer you not to see this symbol of the depths of the plague still crippling the world's economies. | |

The 'ghost fleet' near Singapore. The world's ship owners and government economists would prefer you not to see this symbol of the depths of the plague still crippling the world's economies The tropical waters that lap the jungle shores of southern Malaysia could not be described as a paradisical shimmering turquoise. They are more of a dark, soupy green. They also carry a suspicious smell. Not that this is of any concern to the lone Indian face that has just peeped anxiously down at me from the rusting deck of a towering container ship; he is more disturbed by the fact that I may be a pirate, which, right now, on top of everything else, is the last thing he needs.

His appearance, in a peaked cap and uniform, seems rather odd; an o fficer without a crew. But there is something slightly odder about the vast distance between my jolly boat and his lofty position, which I can't immediately put my finger on.

Then I have it - his 750ft-long merchant vessel is standing absurdly high in the water. The low waves don't even bother the lowest mark on its Plimsoll line. It's the same with all the ships parked here, and there are a lot of them. Close to 500. An armada of freighters with no cargo, no crew, and without a destination between them.

My ramshackle wooden fishing boat has floated perilously close to this giant sheet of steel. But the face is clearly more scared of me than I am of him. He shoos me away and scurries back into the vastness of his ship. His footsteps leave an echo behind them.

Navigating a precarious course around the hull of this Panama-registered hulk, I reach its bow and notice something else extraordinary. It is tied side by side to a container ship of almost the same size. The mighty sister ship sits empty, high in the water again, with apparently only the sailor and a few lengths of rope for company. Nearby, as we meander in searing midday heat and dripping humidity between the hulls of the silent armada, a young European offi cer peers at us from the bridge of an oil tanker owned by the world's biggest container shipping line, Maersk. We circle and ask to go on board, but are waved away by two Indian crewmen who appear to be the only other people on the ship. 'They are telling us to go away,' the boat driver explains. 'No one is supposed to be here. They are very frightened of pirates.' Here, on a sleepy stretch of shoreline at the far end of Asia, is surely the biggest and most secretive gathering of ships in maritime history. Their numbers are equivalent to the entire British and American navies combined; their tonnage is far greater. Container ships, bulk carriers, oil tankers - all should be steaming fully laden between China, Britain, Europe and the US, stocking camera shops, PC Worlds and Argos depots ahead of the retail pandemonium of 2009. But their water has been stolen.

They are a powerful and tangible representation of the hurricanes that have been wrought by the global economic crisis; an iron curtain drawn along the coastline of the southern edge of Malaysia's rural Johor state, 50 miles east of Singapore harbour.

It is so far off the beaten track that nobody ever really comes close, which is why these ships are here. The world's ship owners and government economists would prefer you not to see this symbol of the depths of the plague still crippling the world's economies.

So they have been quietly retired to this equatorial backwater, to be maintained only by a handful of bored sailors. The skeleton crews are left alone to fend off the ever-present threats of piracy and collisions in the congested waters as the hulls gather rust and seaweed at what should be their busiest time of year.

Local fisherman Ah Wat, 42, who for more than 20 years has made a living fishing for prawns from his home in Sungai Rengit, says: 'Before, there was nothing out there - just sea. Then the big ships just suddenly came one day, and every day there are more of them.

'Some of them stay for a few weeks and then go away. But most of them just stay. You used to look Christmas from here straight over to Indonesia and see nothing but a few passing boats. Now you can no longer see the horizon.'

The size of the idle fleet becomes more palpable when the ships' lights are switched on after sunset. From the small fishing villages that dot the coastline, a seemingly endless blaze of light stretches from one end of the horizon to another. Standing in the darkness among the palm trees and bamboo huts, as calls to prayer ring out from mosques further inland, is a surreal and strangely disorientating experience. It makes you feel as if you are adrift on a dark sea, staring at a city of light.

Ah Wat says: 'We don't understand why they are here. There are so many ships but no one seems to be on board. When we sail past them in our fishing boats we never see anyone. They are like real ghost ships and some people are scared of them. They believe they may bring a curse with them and that there may be bad spirits on the ships.'

|

|

| Two container ships tied together in southern Malaysia, waiting for the next charter. | |

As daylight creeps across the waters, flags of convenience from destinations such as Panama and the Bahamas become visible. In reality, though, these vessels belong to some of the world's biggest Western shipping companies. And the sickness that has ravaged them began far away - in London, where the industry's heart beats, and where the plummeting profits and hugely reduced cargo prices are most keenly felt.

The Aframax-class oil tanker is the camel of the world's high seas. By definition, it is smaller than 132,000 tons deadweight and with a breadth above 106ft. It is used in the basins of the Black Sea, the North Sea, the Caribbean Sea, the China Sea and the Mediterranean - or anywhere where non-OPEC exporting countries have harbours and canals too small to accommodate very large crude carriers (VLCC) or ultra-large crude carriers (ULCCs). The term is based on the Average Freight Rate Assessment (AFRA) tanker rate system and is an industry standard.

"A couple of years ago these ships would be steaming back and forth. Now 12 per cent are doing nothing."

You may wish to know this because, if ever you had an irrational desire to charter one, now would be the time. This time last year, an Aframax tanker capable of carrying 80,000 tons of cargo would cost £31,000 a day ($50,000). Now it is about £3,400 ($5,500).

This is why the chilliest financial winds anywhere in the City of London are to be found blowing through its 400-plus shipping brokers. Between them, they manage about half of the world's chartering business. The bonuses are long gone. The last to feel the tail of the economic whiplash, they - and their insurers and lawyers - await a wave of redundancies and business failures in the next six months. Commerce is contracting, fleets rust away - yet new ship-builds ordered years ago are still coming on stream.

Just 12 months ago these financiers and brokers were enjoying fat bonuses as they traded cargo space. But nobody wants the space any more, and those that still need to ship goods across the world are demanding vast reductions in price. Do not tell these men and women about green shoots of recovery. As Briton Tim Huxley, one of Asia's leading ship brokers, says, if the world is really pulling itself out of recession, then all these idle ships should be back on the move.

'This is the time of year when everyone is doing all the Christmas stu ff,' he points out. "A couple of years ago those ships would have been steaming back and forth, going at full speed. But now you've got something like 12 per cent of the world's container ships doing nothing."

Aframaxes are oil bearers. But the slump is industry-wide. The cost of sending a 40ft steel container of merchandise from China to the UK has fallen from £850 plus fuel charges last year to £180 this year. The cost of chartering an entire bulk freighter suitable for carrying raw materials has plunged even further, from close to £185,000 ($300,000) last summer to an incredible £6,100 ($10,000) earlier this year.

Business for bulk carriers has picked up slightly in recent months, largely because of China's rediscovered appetite for raw materials such as iron ore, says Huxley. But this is a small part of international trade, and the prospects for the container ships remain bleak.

Some experts believe the ratio of container ships sitting idle could rise to 25 per cent within two years in an extraordinary downturn that shipping giant Maersk has called a 'crisis of historic dimensions'. Last month the company reported its first half-year loss in its 105-year history.

Martin Stopford, managing director of Clarksons, London's biggest ship broker, says container shipping has been hit particularly hard: "In 2006 and 2007 trade was growing at 11 per cent. In 2008 it slowed down by 4.7 per cent. This year we think it might go down by as much as eight per cent. If it costs £7,000 a day to put the ship to sea and if you only get £6,000 a day, than you have got a decision to make."

"Yet at the same time, the supply of container ships is growing. This year, supply could be up by around 12 per cent and demand is down by eight per cent. Twenty per cent spare is a lot of spare of anything - and it's come out of nowhere." These empty ships should be carrying Christmas goods over to the West. All retailers will have already ordered their stock for the festive season long ago. With more than 92 per cent of all goods coming into the UK by sea, much of it should be on its way here if it is going to make it to the shelves before Christmas.

|

|

| Lights from the fleet of ships illuminate the night-time horizon. | |

But retailers are running on very low stock levels, not only because they expect consumer spending to be down, but also because they simply do not have the same levels of credit that they had in the past and so are unable to keep big stockpiles. Stopford explains: 'Globalisation and shipping go hand in hand. Worldwide, we ship about 8.2 billion tons of cargo a year. That's more than one ton per person and probably two to three tons for richer people like us in the West. If the total goes down by five per cent or so, that's a lot of cargo that isn't moving.'

The knock-on effect of so many ships sitting idle rather than moving consumer goods between Asia and Europe could become apparent in Britain in the months ahead. "We will find out at Christmas whether there are enough PlayStations in the shops or not. There will certainly be fewer goods coming in during the run-up to Christmas."

Three thousand miles north-east of the ghost fleet of Johor, the shipbuilding capital of the world rocks to an unpunctuated chorus of hammer-guns blasting rivets the size of dustbin lids into shining steel panels that are then lowered onto the decks of massive new vessels. As the shipping industry teeters on the brink of collapse, the activity at boatyards like Mokpo and Ulsan in South Korea all looks like a sick joke. But the workers in these bustling shipyards, who teem around giant tankers and mega-vessels the length of several football pitches and capable of carrying 10,000 or more containers each, have no choice; they are trapped in a cruel time warp.

There have hardly been any new orders. In 2011 the shipyards will simply run out of ships to build. A decade ago, South Korean President Kim Dae-jung (who died last month) issued a decree to his industrial captains: he wished to make his nation the market leader in shipbuilding. He knew the market intimately. Before entering politics, he studied economics and worked for a Japanese-owned freight-shipping business. Within a few years he was heading his own business, starting out with a fleet of nine ships. Thus, by 2004, Kim Dae-jung's presidential vision was made real. His country's low-cost yards were winning 40 per cent of world orders, with Japan second with 24 per cent and China way behind on 14 per cent.

But shipbuilding is a horrendously hard market to plan. There is a three-year lag between the placing of an order and the delivery of a ship. With contracts signed, down-payments made and work under way, stopping work on a new ship is the economic equivalent of trying to change direction in an ocean liner travelling at full speed towards an iceberg.

Thus the labours of today's Korean shipbuilders merely represent the completion of contracts ordered in the fat years of 2006 and 2007. Those ships will now sail out into a global economy that no longer wants them.

Maersk announced last week that it was renegotiating terms and prices with Asian shipyards for 39 ordered tankers and gas carriers. One of the company's executives, Kristian Morch, said the shipping industry was in uncharted waters.

As he told the global shipping newspaper Lloyd's List only last week: 'You have a contraction of oil demand, you have a falling world economy and you have a contraction of financing capabilities - and at the same time as a lot of new ships are being delivered.'

Demand peaked in 2005 when, with surplus tonnage worldwide standing at just 0.7 per cent, ship owners raced to order, fearing docks and berths at major shipyards would soon be fully booked. That spell of 'panic buying' has heightened today's alarming mismatch between supply and demand.

Keith Wallis, East Asia editor of Lloyd's List, says, 'There was an ordering frenzy on all types of vessel, particularly container ships, because of the booming trade between Asia and Europe and the United States. It was fuelled in particular by consumer demand in the UK, Europe and North America, as well as the demand for raw materials from China.'

|

|

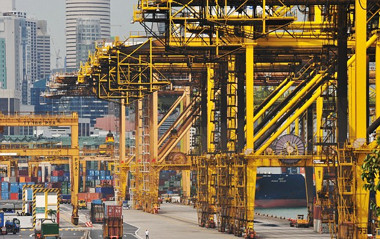

| Cranes at Singapore Dock stand idle, waiting for work. | |

Orders for most existing ships to be delivered within the next six to nine months would be honoured, he predicted, and the ships would go into service at the expense of older vessels in the fleet, which would be scrapped or end up anchored off places like southern Malaysia.

But, says Wallis, "some ship owners won't be able to pay their final instalments when the vessels are completed. Normally, they pay ten per cent down when they order the ship and there are three or four stages of payment. But 50 to 60 per cent is paid on delivery."

South Korean shipyard Hanjin Heavy Industries last week said it had been forced to put up for sale three container ships ordered at a cost of £60 million ($100 million) by the Iranian state shipping line after the Iranians said they could not pay the bill.

"The prospects for shipyards are bleak, particularly for the South Koreans, where they have a high proportion of foreign orders. Whole communities in places like Mokpo and Ulsan are involved in shipbuilding and there is a lot of sub-contracting to local companies," Wallis says. "So far the shipyards are continuing to work, but the problems will start to emerge next year and certainly in 2011, because that is when the current orders will have been delivered. There have hardly been any new orders in the past year. In 2011, the shipyards will simply run out of ships to build."

Christopher Palsson, a senior consultant at London-based Lloyd's Register-Fairplay Research, believes the situation will worsen before it gets better. "Some ships will be sold for demolition but the net balance will be even further pressure on the freight rates and the market itself. A lot of ship owners and operators are going to find themselves in a very difficult situation."

The current downturn is the worst in living memory and more severe even than the slump of the early Eighties, Palsson believes. "Back then the majority of the crash was for tankers carrying crude oil. Today we have almost every aspect of shipping affected - bulk carriers, tankers, container carriers... the lot. It is a much wider-spread situation that we have today. China was not a major player in the world economy at that time. Neither was India. We had the Soviet Union. We had shipbuilding in the United Kingdom and Europe. But then, back in those days the world was a very different place."

Most recent articles:

[an error occurred while processing this directive]